If you are not eligible to charge Input tax credit then following entry should be passed:

Bank Charges A/c Debit

To Bank A/c Credit

If you are eligible to claim input tax credit then following entry should be passed based on the amount that is bieng charged.

Bank Charges A/c Debit

CGST Input A/c Debit

SGST Input A/c Debit

To Bank A/c Credit

For example if bank has charged Rs.295 as bank expense :

Bank Charges A/c Debit Rs. 250

CGST Input A/c Debit Rs. 22.5

SGST Input A/c Debit Rs. 22.5

To Bank A/c Credit Rs. 295

Bank charges being expense wil be debited and GST Input Tax bieng asset will be debited.

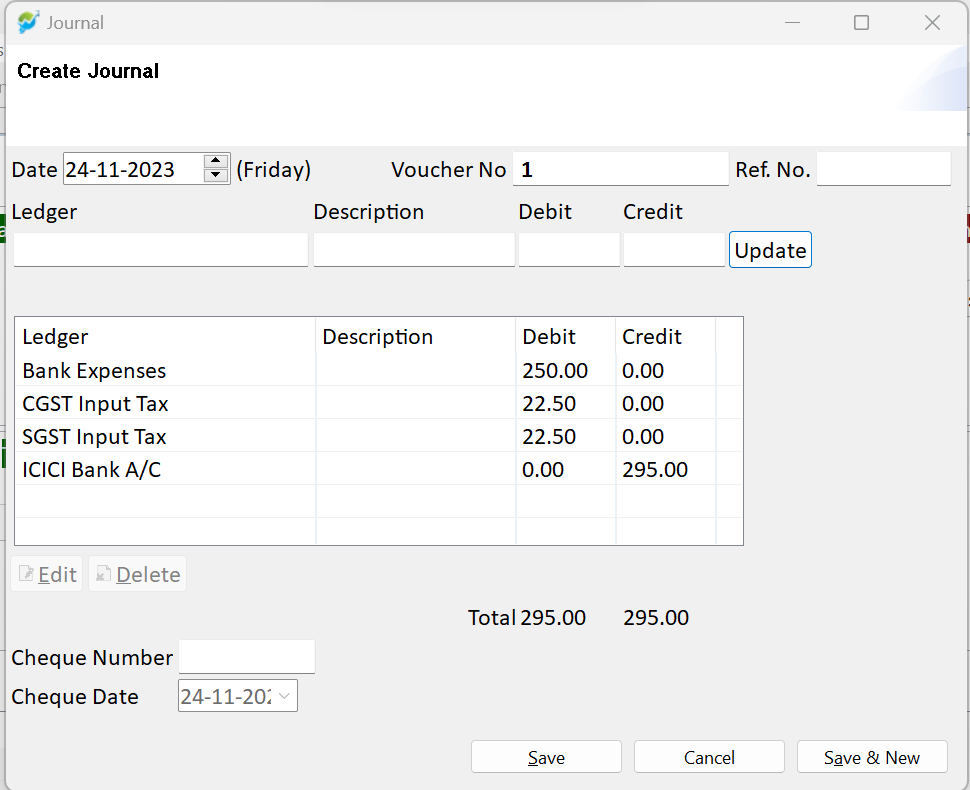

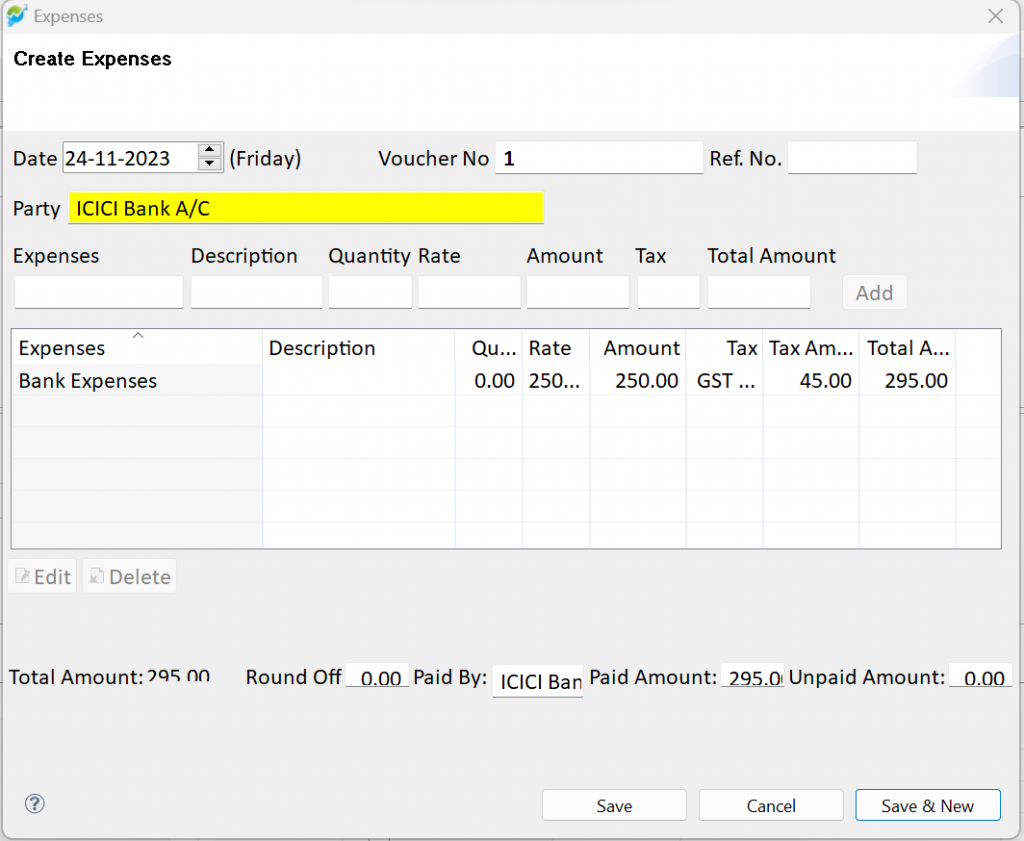

In Innoventry you can record this entry by two ways:

- Journal Transaction: To open the Journal Transaction window , press F7 from your keyboard or go to Transaction Menu and click on Journal. Pass following entry with the amount of your transaction uner respective account heads.

- Expense Transaction

In expense transaction make sure to select your bank account under Paid By and also enter Paid amount.

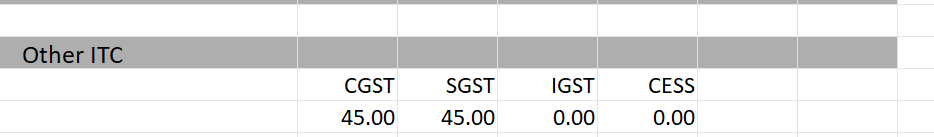

ITC will be visible in GSTR 3B under Other ITC.