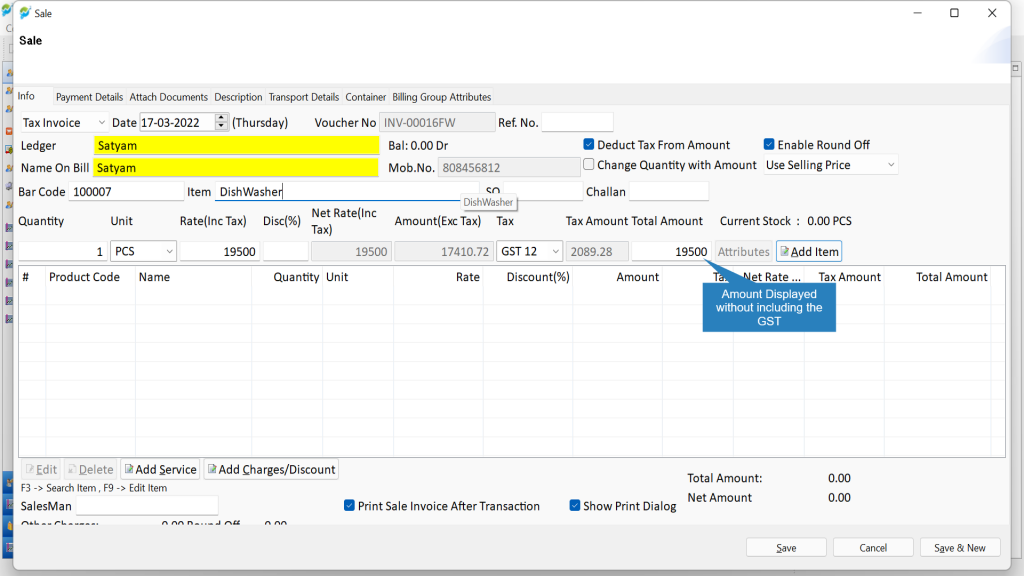

There may be instances where the user wants to deduct taxes during transactions. For example for a commodity sold in MRP, the GST is already included in the MRP, in this case the user will not require addition of a separate GST% to the final bill amount. The user in Innoventry can perform tax inclusive transaction or a transaction where the amount should be displayed excluding taxes.

For instance, if in any sale transaction the billing amount is ₹1000, with GST 12% then total bill amount will be ₹1120. However, due to the commodity being sold at MRP or a price including tax already or any other reason, billing can be done as required. In case the user does not want an addition GST to be applied then they can use this feature of the software. In the example given, the total bill amount will be displayed as ₹1000 if “Deduct tax from Amount” option is used.

>>To enable Tax Deduction in Sales follow the below steps: #

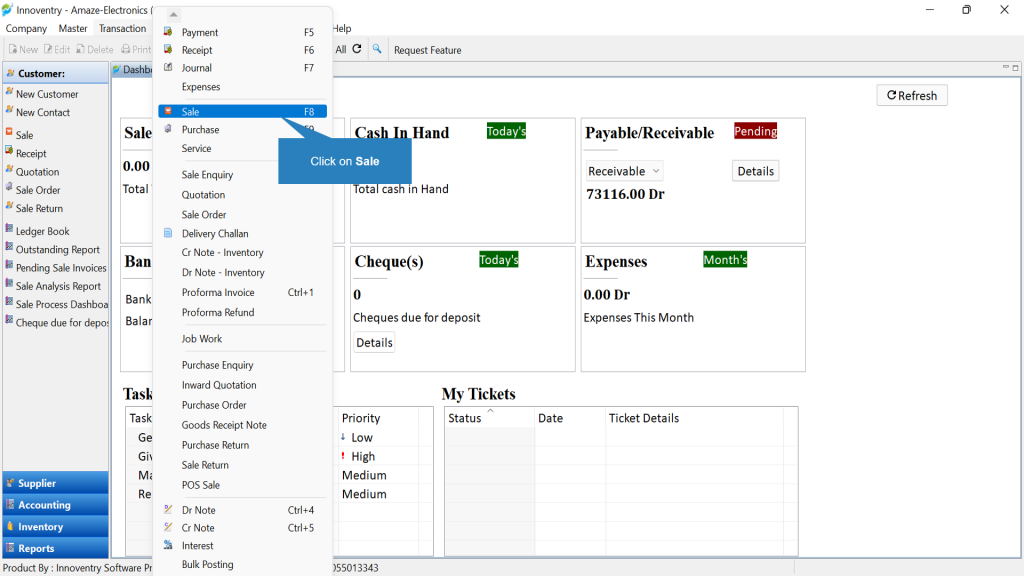

Step 1: Go to Transaction > Sale.

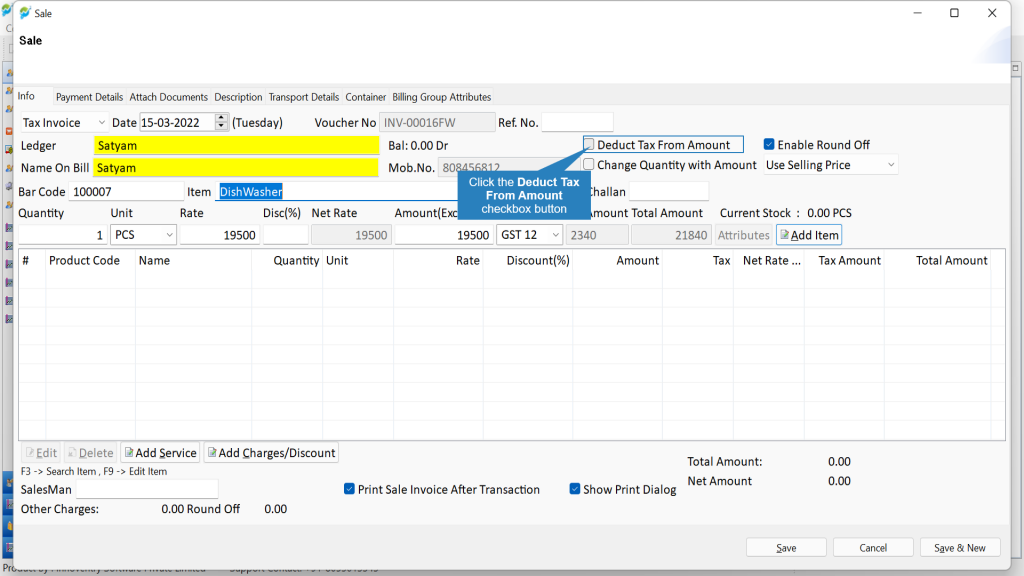

Step 2: In sale frame you can tick checkbox of ‘Deduct tax from amount.

>>If you want to Use Deduct Tax from Amount in all transaction then you need to enable settings for Deduct Tax from Amount. #

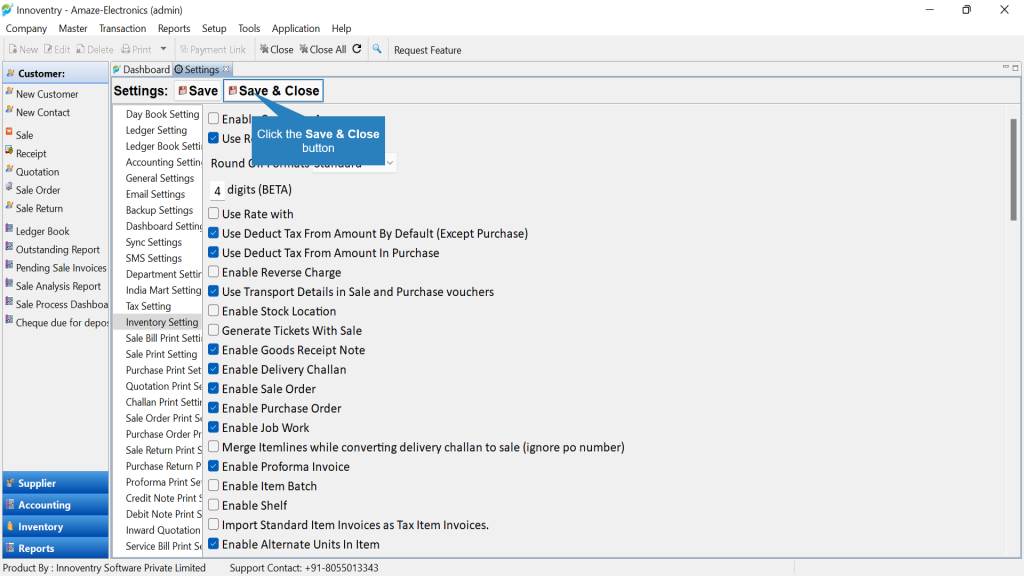

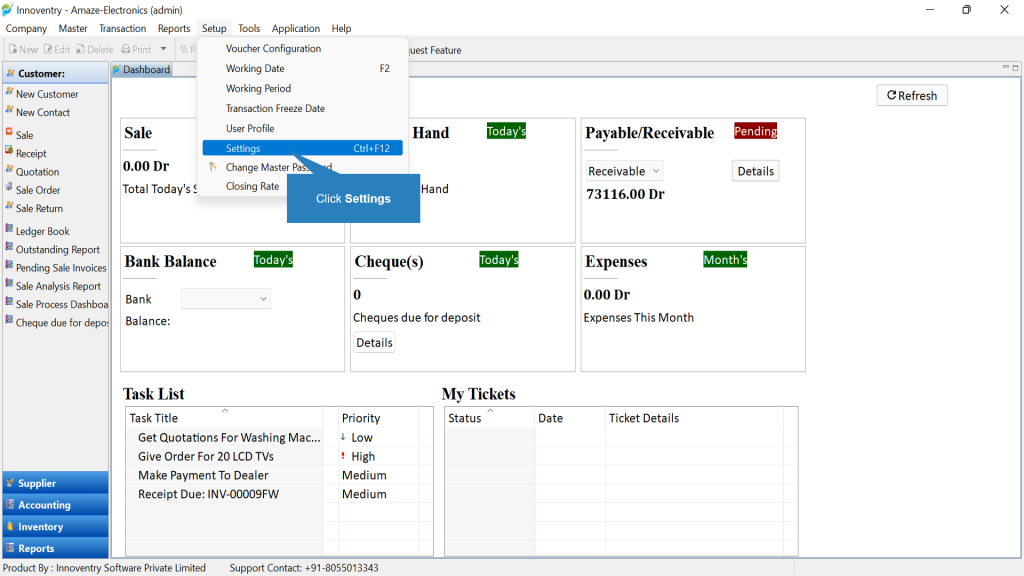

Step 1: Go to Setup > Settings

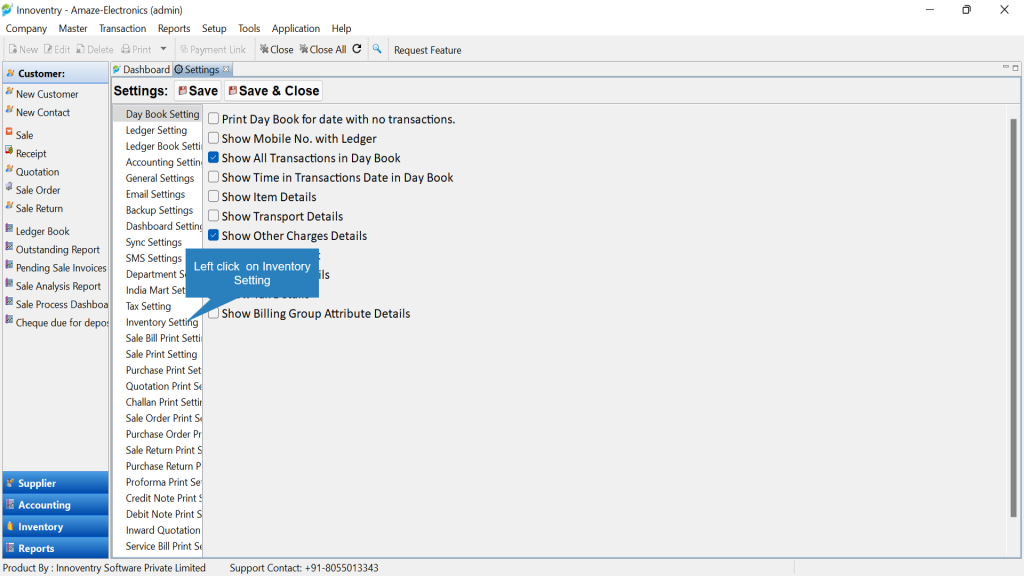

Step 2: Select Inventory Setting from the list of settings.

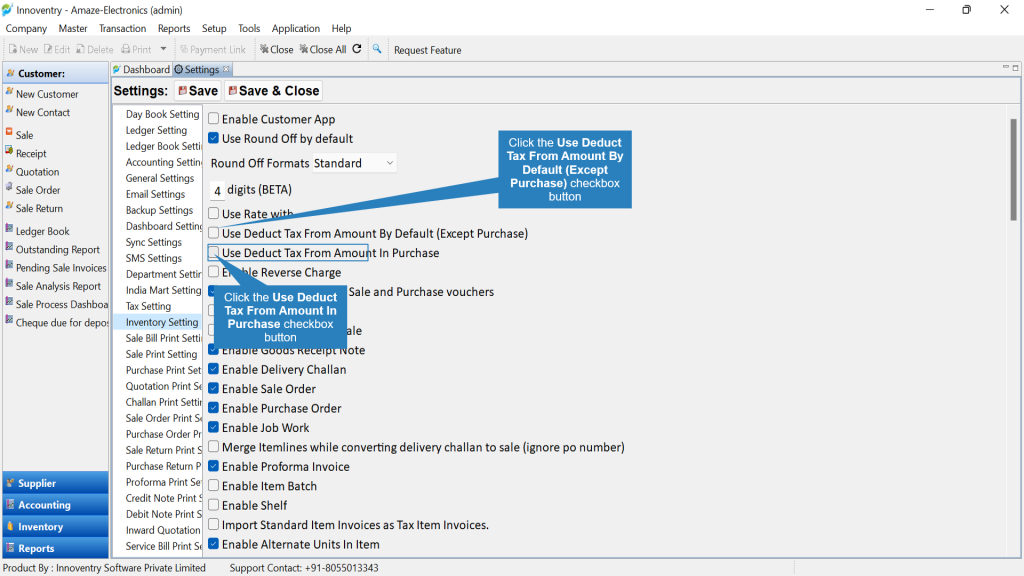

Step 3: Here the user gets two option relating to tax deduction by default.

Option 1: Check the ‘Deduct Tax From Amount By Default(except purchase) ’‘ checkbox in case the user wants to make the tax deduction default in all transactions except purchase.

Option 2: Check the ‘Deduct Tax From Amount By Default in Purchase ’‘ checkbox in case the user wants to make the tax deduction default in purchase transactions only.

Step 4: Click on the “SAVE & CLOSE” button to save the changes and close the settings.