Outstanding Reports And Reminders

Credits have been the integral component of business since the history of mankind. A business in this modern scenario cannot work without the system and balance of credits and outstandings. With the increase in flow-chain of businesses these days, the management of credits has become quite complex.

Outstanding in business terminology means the amount due to be paid or received by the business. In terms of bookkeeping, balance or outstanding is the sum of credit entries and debit entries on the account in a financial year. Whether the outstanding is payable or receivable can be determined by adding or subtracting these two components. So now we know that outstanding can be broadly of two types for a business.

Suppose, a retail business buys a product from the dealer. It might be the case that the commodity is bought on credit for certain number of days. So the amount which is due to be given to the dealer is called as a “Payable” outstanding. I.e. the amount that the business owes to a certain party. Whereas, if the same retail business sells some commodity to a buyer on credit, the amount due to be received by the retailer will be called as “Receivable” outstanding. I.e. the amount that a party owes towards the business.

Hence, overall the concept of outstanding tends to the fact that the exchange of commodities has already taken place, although the cash flow has not taken place yet.

Why we need to manage Payables and Receivables?

The principle for a transparent business accounting requires keeping track of all the payables and receivables. The payment of dues on time by the business largely determines the reputation of the business in the market. If the business has kept a good track record in paying the dues to the businesses they have been dealing with, they are liable to get better concessions and good deals. It’s just like maintaining a healthy credit score by an individual.

A typical business model in the regular retail market works in a very straightforward manner. The retailer buys products from dealer on credit for certain days. The retailer then sells the product on his outlet or store. The amount now with the retailer is paid to the dealer after cutting off the margin of the retailer. So receiving the money from customers is a vital step in the flow-process of cash in the business. And the account of net payables is also important so that the business can know at every point of time how much it owes to a party.

Although, if we speak about the dealer in this case. The receivable amount acts as the major concern for him. An authentic and systematic accounting of the receivables is a must for the dealer as he may in turn have some outstanding payable to a third party.

How to track Payables and Receivables?

We already saw how important keeping a track of our payables and receivables is in the business. But suppose, after every transaction one has to maintain a separate records of the payable or receivable. This is quite tedious and very illogical job to do. One can think of multiple drawbacks on this. To sum up some of them, there is high chance of missing on the entry, multiple inputs of the same data can result in discrepancies and mistakes. Also there will be a considerable amount of time spent on it and then it may result in engagement of more manpower and more expenses on the account of the business.

We know, there’s always a solution. The huddle of managing payables and receivables can be pretty tough to run through. But, the modern solutions like billing, accounting and inventory management software are a great aid for the efficiency of the business. These software help the businessman in creating a record of outstanding in a very automatic manner.

For example, if a sales transaction is created with partial or no payment. The software automatically adds the data to the receivable register. Similarly, if in a purchase transaction if the purchase receipt is created without the exchange of money, the software automatically adds the amount due to the payable outstanding.

Managing Outstandings On Innoventry

Record and Track Dues: It becomes quite easy for the user to get an overview of the amount the business owes to its creditors. It can give description and detail of all the pending payables bifurcated in accounts of each creditor. Also, the time and amount due can be found at a glance at the outstanding report dashboard on the Innoventry software. Managing your outstanding payables will help you to know the time-to-time expenses, avoid overseeing the outstanding payments that you owe to the creditors, and help you manage the cash-flow in your business.

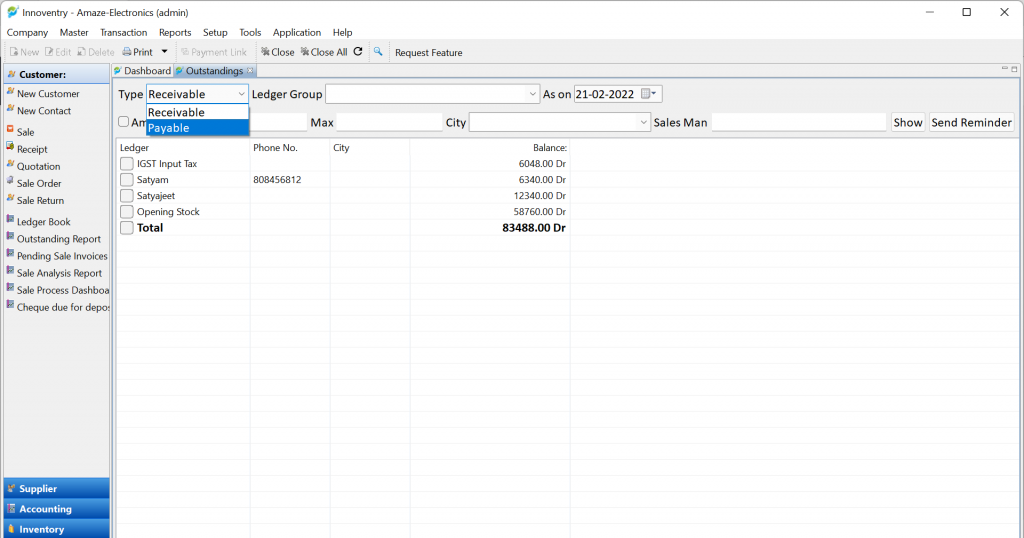

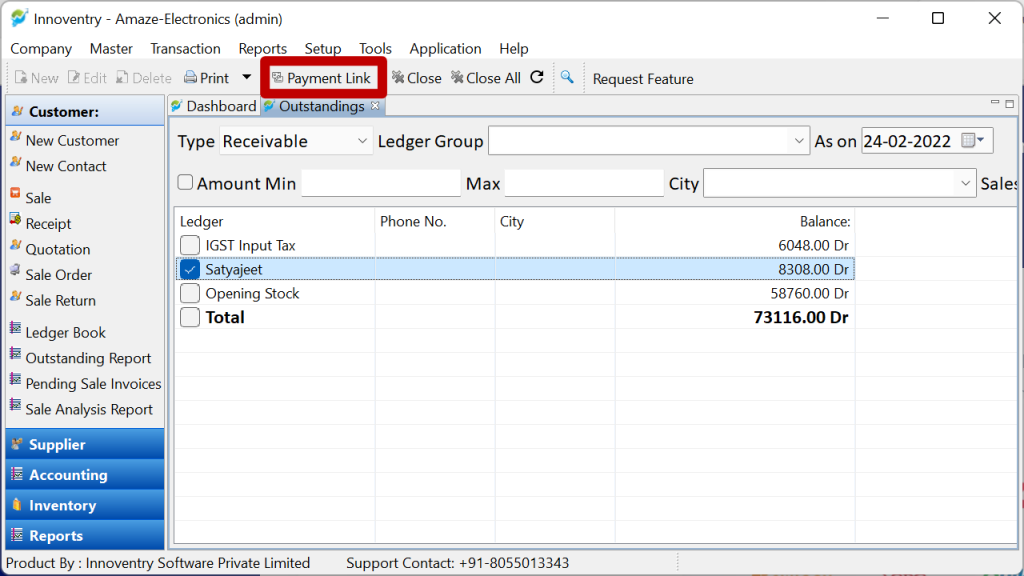

The user can also manage and view the net receivables from the same dashboard just by selecting the receivables option from the drop down list as seen in the below snapshot.

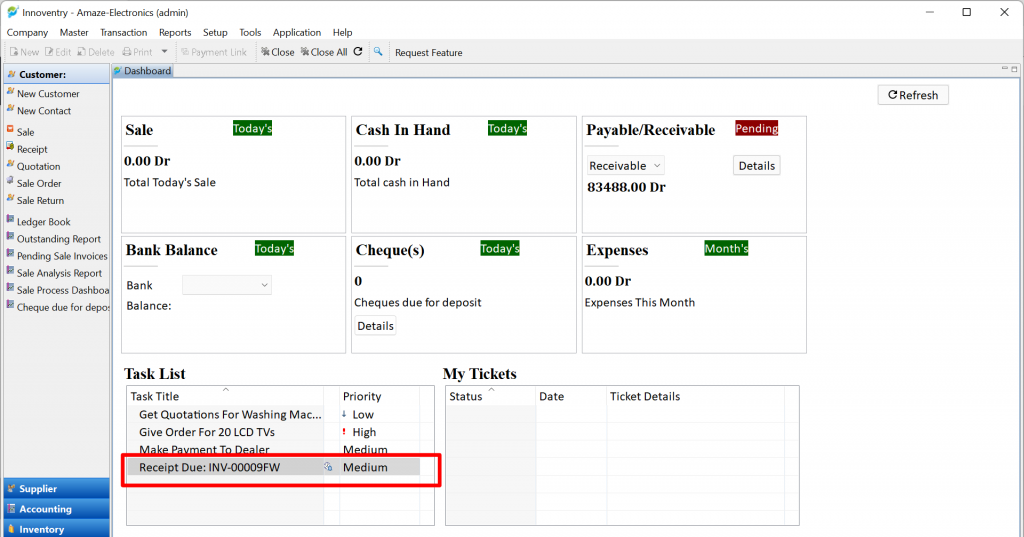

Use of Credit Period: The user or biller if performing a transaction on the Innoventry software can feed in the agreed number of credit days. The software automatically shows reminders about them on the main dashboard of the software. This helps to avoid conflicts with your parties, systematically track your outstanding payables, and make timely payments to your parties.

Bill-by-Bill Outstanding Updation: The software automatically gets to know that the payment is due if the user has fed in the transaction. For example, if in a sale transaction of total ₹2,500 and the amount received is fed as ₹2,100, the software will automatically update the outstanding dashboard as outstanding receivable of ₹400.

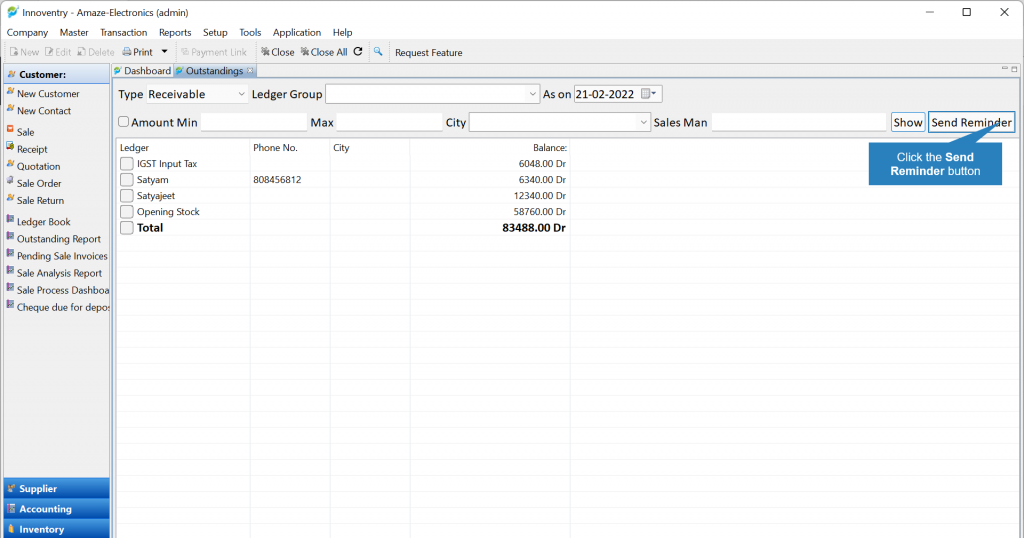

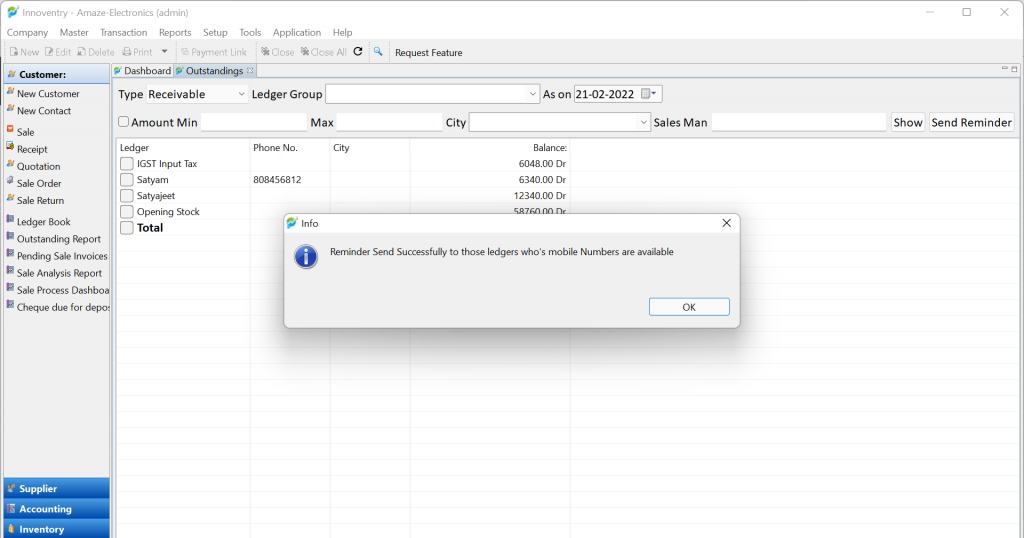

Feature To Send Reminders : The software is equipped with feature of sending reminders. The software can automatically send reminders to the concerned party for both payables and receivables in the form of the text message. The user can send reminders for all the parties at one or can select the parties individually to send reminders. So no more hassle of calling parties again and again. The business can do it by the click of a button.

The early we receive our receivables, the better is for the business. One of the barriers which the business faces is, the medium of payment. The processes such as bank transfer from net banking, NEFT and RTGS are quite slow and cumbersome. Using Innoventry, the business can send Payment Link to the ledger whose payment in pending using the, “Payment Link” option in the tool bar. This payment link feature being so versatile in nature can be in the form of “Razorpay“, “Hylobiz“, “PayTM” or “QR Code“.

Now managing outstandings is not a tricky task anymore. Enjoy the freedom and stress free business flow with Innoventry. No chance to miss a receivable and no chance to miss a payment due date.